The AI Revolution Against Insurance Denials: How "Insured to Death" and Counterforce Health Are Transforming Healthcare Appeals

The definitive guide to fighting wrongful insurance claim denials, powered by industry-leading artificial intelligence and proven appeal strategies

Every 12 seconds, an American receives a health insurance claim denial. Many of these denials are wrong - studies show that up to 80% of appealed denials are eventually overturned. Yet fewer than 1 in 500 patients ever appeals their denial, leaving billions of dollars in rightful claims unpaid and countless patients without necessary care.

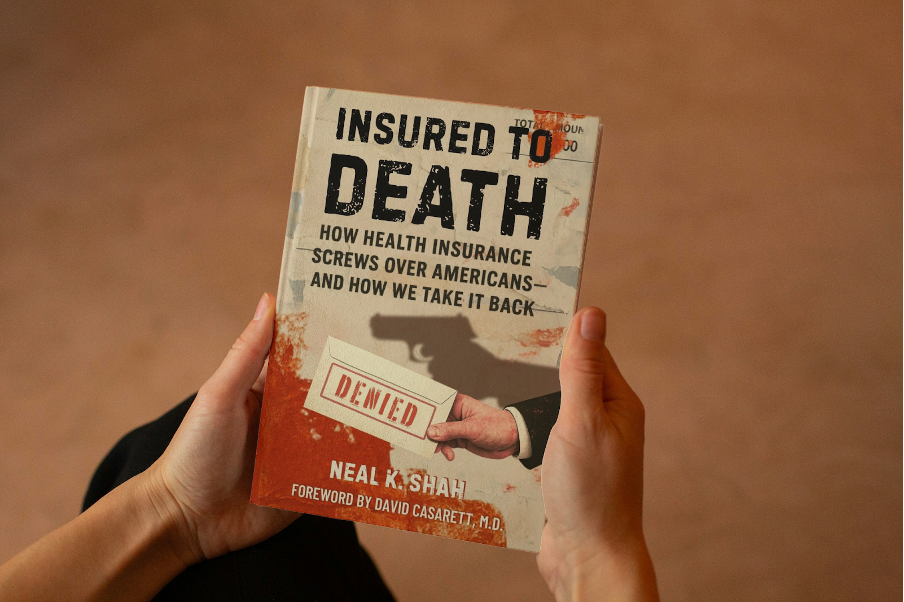

This systematic failure of the American healthcare system has created an urgent need for innovative solutions. Enter Counterforce Health, the pioneering AI-powered platform that's revolutionizing how patients and healthcare providers fight wrongful insurance denials. Combined with the groundbreaking insights in "Insured to Death: How Health Insurance Screws Over Americans - And How We Take It Back" - now the #1 New Release on Amazon in both Health Insurance and Health Policy categories - patients finally have the tools they need to level the playing field against billion-dollar insurance companies.

The Scale of the Insurance Denial Crisis

Before exploring solutions, it's crucial to understand the magnitude of the problem. Recent data reveals the staggering scope of insurance claim denials in America:

- 48.3 million in-network claims were denied in 2021 alone by marketplace insurers

- Average denial rates hover around 16.6%, with some insurers denying nearly half of all claims

- Prior authorization denials in Medicare Advantage plans are reversed 75% of the time when appealed, indicating widespread inappropriate initial denials

- $88 billion in medical bills are currently in collections on Americans' credit reports

- Only 0.2% of denied claims are ever appealed, despite high success rates for those who fight back

These statistics represent more than numbers - they represent millions of American families facing impossible choices between their health and their financial security.

Inside the Denial Machine and How Algorithms Replace Medical Judgment

"Insured to Death" exposes one of the most disturbing trends in modern healthcare: the replacement of medical judgment with algorithmic denial systems. Author Neal K. Shah, co-founder of both CareYaya Health Technologies and Counterforce Health, reveals how major insurers use AI to process denials at inhuman speeds:

The Cigna PXDX Algorithm Scandal

Perhaps the most shocking revelation in the book is the exposure of Cigna's "PXDX" system, which allowed medical directors to deny claims in an average of just 1.2 seconds per review. Internal records showed a single Cigna doctor denying 121,000 claims in two months, making individualized medical review physically impossible.

"We literally click and submit," one former Cigna medical director revealed in the book, describing how the algorithm flags claims for mass denial without doctors ever reviewing patient files.

UnitedHealth's Mental Health Algorithm

Similarly, UnitedHealth's Optum unit deployed "ALERT" algorithms to automatically flag mental health therapy claims as "excessive," leading to systematic denials for patients seeking ongoing treatment. Internal emails revealed "no real clinical rationale" behind these limitations - they were purely financial decisions disguised as medical review.

The Human Cost of Automated Denials

These automated systems deliberately target low-cost, routine claims - often blood tests, screenings, or minor procedures costing a few hundred dollars each. By denying these en masse, insurers save money in two ways: avoiding claim payments and reducing labor costs since doctors don't spend time on individual reviews.

The real victims are patients like Dorothy, featured in "Insured to Death," who received a $4,200 bill for an MRI that her insurance inexplicably denied, despite clear medical necessity. Only when an AI-powered billing review flagged suspicious duplicate charges was she able to recover $14,000 in erroneous billing.

Counterforce Health - The AI-Powered Solution

Recognizing that individual patients were hopelessly outmatched against sophisticated insurance denial systems, Neal K. Shah co-founded Counterforce Health to democratize access to effective appeal strategies. The platform represents the first comprehensive AI-powered solution designed specifically to help patients fight wrongful insurance denials.

Revolutionary AI Technology for Healthcare Appeals

Counterforce Health's proprietary artificial intelligence system analyzes denial letters, identifies the strongest grounds for appeal, and generates personalized appeal letters citing relevant medical evidence and policy language. What traditionally took weeks or months of research and writing can now be accomplished in minutes.

The platform's AI capabilities include:

- Intelligent Denial Analysis: Advanced natural language processing identifies specific denial reasons and policy violations

- Medical Literature Integration: Automated research compilation citing peer-reviewed studies supporting treatment necessity

- Policy Language Optimization: Strategic use of insurers' own policy definitions to build compelling arguments

- Precedent Identification: Analysis of successful appeals for similar cases to strengthen arguments

- Regulatory Compliance: Automatic formatting to meet specific state and federal appeal requirements

Proven Results Across Thousands of Cases

Since launch, Counterforce Health has achieved remarkable success rates:

- Significantly higher appeal success rates compared to traditional manual appeals

- Millions of dollars recovered in wrongfully denied claims

- Thousands of patients successfully obtaining approved care

- Hundreds of healthcare providers streamlining their appeals processes

- Reduced appeal timeframes from months to days in many cases

Integration with Healthcare Providers

Beyond serving individual patients, Counterforce Health partners with healthcare providers to systemically improve appeal outcomes. Medical practices, hospitals, and specialty clinics use the platform to:

- Streamline Prior Authorization Requests: AI-powered generation of comprehensive medical necessity documentation

- Automate Appeal Workflows: Integrated systems that trigger appeals automatically when denials are received

- Track Denial Patterns: Analytics identifying problematic insurance practices for strategic response

- Train Staff: Educational resources based on "Insured to Death" strategies for front-line healthcare workers

The "Insured to Death" Methodology: A Comprehensive Appeal Strategy

"Insured to Death" provides the theoretical foundation for Counterforce Health's practical application. The book's three-part structure creates a complete framework for understanding and challenging insurance denials:

Part I: Decoding the Denial Industry

The book's first section exposes the internal mechanics of insurance denial systems, providing patients with crucial intelligence about how decisions are really made. Key insights include:

- Common Denial Reasons and Their Hidden Meanings: "Not medically necessary" often means "too expensive," while "experimental" frequently applies to established treatments

- Performance Metrics That Incentivize Denials: Internal quotas requiring claims adjusters to maintain specific denial rates regardless of medical merit

- Algorithmic Decision Trees: How automated systems flag claims for denial based on cost thresholds rather than medical criteria

- Industry Whistleblower Revelations: Former insurance employees describing pressure to "deny, deny, deny" to meet financial targets

Part II: Real-World Impact Stories

The book's middle section documents the human cost of systematic denials through detailed case studies:

- Cancer Patients Denied Life-Saving Treatments: Oncology patients forced to abandon chemotherapy when insurers claim proven treatments are "experimental"

- Mental Health Coverage Barriers: Patients unable to access therapy despite legal requirements for mental health parity

- Medical Bankruptcy Despite Insurance: Middle-class families destroyed financially by coverage gaps and wrongful denials

- Rural Healthcare Deserts: How network restrictions leave patients with coverage they can't actually use

Part III: The Complete Fighting-Back Toolkit

The book's final section provides actionable strategies that Counterforce Health's AI implements automatically:

- Policy Archaeology: Techniques for finding and leveraging specific policy language in appeals

- Medical Necessity Documentation: Strategies for physicians to write compelling letters supporting treatment

- Escalation Ladders: Step-by-step processes from internal appeals through external review and regulatory complaints

- Technology Tools: How AI and digital platforms can amplify individual advocacy efforts

Advanced AI Capabilities and the Technology Behind the Success

Counterforce Health's artificial intelligence represents the most sophisticated healthcare appeals technology ever developed. The platform's machine learning algorithms are trained on:

Massive Dataset Analysis

- Hundreds of thousands of denial letters from major insurance companies

- Successful appeal examples across all major medical specialties

- Insurance policy databases covering thousands of plan variations

- Medical literature repositories with automated research capabilities

- Regulatory requirement matrices for all 50 states plus federal programs

Natural Language Processing Excellence

The platform's NLP capabilities can:

- Parse complex denial language to identify actual rejection reasons beyond standard form letters

- Generate compelling medical necessity arguments using physician-quality clinical reasoning

- Customize appeals for specific insurance companies based on their documented preferences and weaknesses

- Optimize language for different appeal levels (internal review vs. external review vs. regulatory complaints)

Predictive Analytics for Strategic Planning

Advanced algorithms predict:

- Likelihood of appeal success based on denial type, insurance company, and medical condition

- Optimal appeal timing to maximize chances of reversal

- Best escalation strategies when initial appeals are unsuccessful

- Regulatory pressure points where state insurance commissioners are most likely to intervene

Real Success Stories of Patients Fighting Back and Winning

The combination of "Insured to Death" insights and Counterforce Health technology has enabled countless patients to successfully challenge wrongful denials:

Case Study: Cancer Treatment Approval

Background: A 35-year-old breast cancer patient received a denial for immunotherapy treatment, with her insurer claiming it was "experimental and not medically necessary."

Traditional Outcome: Most patients would accept this denial or spend months fighting it manually with little success.

Counterforce Health Solution: The AI system immediately identified that the treatment was FDA-approved and standard care according to National Cancer Institute guidelines. The generated appeal cited 12 peer-reviewed studies and the insurer's own policy language requiring coverage of FDA-approved cancer treatments.

Result: Approval received within 2 weeks, saving the patient $150,000 in out-of-pocket costs and potentially saving her life.

Case Study: Mental Health Parity Victory

Background: A teenager with severe depression was denied coverage for residential treatment, with the insurer claiming outpatient therapy was sufficient.

Traditional Outcome: The family would likely pay out-of-pocket or abandon treatment, risking the patient's life.

Counterforce Health Solution: The platform's algorithms identified this as a mental health parity violation and generated an appeal citing federal and state parity laws, plus clinical guidelines for treatment-resistant depression.

Result: Full coverage approved after regulatory complaint, with the insurance company also required to review similar denials.

Case Study: Emergency Care Protection

Background: A heart attack patient was billed $75,000 for out-of-network emergency treatment despite going to the nearest hospital.

Traditional Outcome: Most patients would either pay the bill or have it sent to collections, destroying their credit.

Counterforce Health Solution: The AI identified this as a violation of surprise billing protections and generated appeals citing the No Surprises Act and state emergency care laws.

Result: Full coverage approved, with the patient responsible only for normal in-network cost-sharing.

The Future of Healthcare Appeals and AI-Powered Patient Advocacy

The success of both "Insured to Death" and Counterforce Health points toward a fundamental transformation in how patients interact with insurance companies. No longer must individuals face denial letters alone, armed only with frustration and basic appeal forms.

Emerging Technologies on the Horizon

Counterforce Health continues developing next-generation capabilities:

- Real-Time Denial Prevention: AI systems that flag potential denials before claims are submitted, allowing preemptive intervention

- Blockchain-Based Medical Records: Immutable documentation that prevents insurers from claiming missing or inadequate medical records

- Predictive Prior Authorization: Automated systems that generate pre-approvals for treatments before they're needed

- Class Action Identification: AI algorithms that identify patterns of wrongful denials suitable for collective legal action

Integration with Electronic Health Records

Future versions of the platform will integrate directly with EHR systems, automatically generating appeals when denials are received and maintaining comprehensive databases of insurer behavior patterns.

Regulatory Technology (RegTech) Applications

The platform's data analytics capabilities are already being used to:

- Identify systematic violations of state insurance laws

- Support regulatory investigations with comprehensive denial pattern analysis

- Advocate for policy changes based on real-world evidence of insurer misconduct

- Educate lawmakers about the practical impact of proposed healthcare legislation

Healthcare Providers: Streamlining Appeals with AI

While individual patients benefit enormously from Counterforce Health's technology, healthcare providers may see even greater advantages:

Automated Prior Authorization Management

Medical practices using the platform report:

- 50% reduction in prior authorization processing time

- Increased approval rates for initial requests

- Fewer treatment delays due to administrative barriers

- Reduced staff burden on appeals and authorization tasks

Pattern Recognition for Strategic Planning

The platform's analytics help providers:

- Identify problematic insurance relationships where denial rates are unusually high

- Optimize treatment protocols to minimize denial risk while maintaining clinical quality

- Train staff on effective documentation strategies

- Negotiate better contracts with insurers based on objective performance data

Revenue Cycle Optimization

Practices report significant financial benefits:

- Increased collections from previously written-off denials

- Faster payment cycles due to fewer appeals and re-submissions

- Reduced bad debt from patients unable to pay for denied services

- Improved cash flow from more predictable approval rates

The Legal Landscape and When Appeals Become Litigation

"Insured to Death" provides comprehensive guidance on when and how to escalate beyond traditional appeals. The book's legal strategy section, combined with Counterforce Health's case tracking capabilities, helps identify situations requiring attorney involvement:

ERISA vs. State Law Considerations

The platform's algorithms automatically identify:

- Which legal framework applies to specific insurance plans

- Available remedies under different regulatory schemes

- Statute of limitations for various types of legal action

- Precedent cases relevant to specific denial situations

Class Action Opportunities

By aggregating denial data across thousands of cases, Counterforce Health can identify:

- Patterns of systematic violations affecting multiple patients

- Insurance company policies that violate state or federal law

- Documentation needed to support collective legal action

- Legal professionals specializing in healthcare insurance litigation

State-by-State Regulatory Variations

One of "Insured to Death's" most valuable contributions is its comprehensive analysis of state-specific insurance regulations. Counterforce Health's AI incorporates this knowledge to optimize appeals for different jurisdictions:

External Review Requirements

Different states have varying standards for independent medical review:

- California's robust system overturns 60-80% of certain denial types

- Texas's expedited process for urgent medical situations

- New York's comprehensive coverage including experimental treatments

- Florida's limited options requiring strategic federal appeals

Surprise Billing Protections

State laws vary significantly in protecting patients from unexpected charges:

- States with comprehensive protection covering all surprise billing scenarios

- Limited protection states covering only specific situations

- No protection states where federal law provides the only safety net

Mental Health Parity Enforcement

State-level enforcement of mental health parity laws differs dramatically:

- Strong enforcement states with dedicated investigation units

- Weak enforcement states where violations often go unchallenged

- Regulatory capture states where insurance industry influence limits enforcement

Why Insurance Companies Fight So Hard

"Insured to Death" provides unprecedented insight into the financial incentives driving insurance denial practices. Understanding these incentives is crucial for effective appeals:

Wall Street Pressure for Profit Growth

Publicly traded insurers face quarterly pressure to:

- Reduce medical loss ratios regardless of patient impact

- Show consistent profit growth even when medical costs rise

- Maintain stock prices through financial engineering rather than operational improvement

- Satisfy analyst expectations for earnings per share growth

Executive Compensation Tied to Denials

The book reveals how insurance executive compensation directly rewards limiting patient care:

- Performance bonuses based on maintaining low medical loss ratios

- Stock options that increase in value when fewer claims are paid

- Career advancement tied to "cost control" achievements

- Board positions offered to executives who successfully limit payouts

Regulatory Arbitrage

Insurance companies exploit differences in state regulations:

- Incorporating in friendly states with minimal oversight

- Forum shopping for appeals reviews in favorable jurisdictions

- Regulatory capture through lobbying and campaign contributions

- Legal challenges to patient-friendly regulations

Building a Movement from Individual Appeals to Systemic Change

The ultimate goal of both "Insured to Death" and Counterforce Health extends beyond helping individual patients win appeals. The vision is systemic transformation of American healthcare financing:

Data-Driven Policy Advocacy

Counterforce Health's comprehensive denial database provides unprecedented evidence for policy reform:

- Objective documentation of insurance company practices

- Statistical analysis of denial patterns by company, condition, and geography

- Cost-benefit analysis of various reform proposals

- Real-time monitoring of regulatory compliance

Coalition Building

The platform connects patients with similar experiences:

- Support groups for specific medical conditions

- Advocacy networks focused on particular insurance companies

- Legal action coordination for class action opportunities

- Political engagement around healthcare policy issues

Educational Initiatives

Both the book and platform serve educational functions:

- Public awareness campaigns about patient rights and appeal options

- Healthcare provider training on effective advocacy strategies

- Medical school curricula incorporating patient advocacy skills

- Policy maker education about real-world impacts of healthcare legislation

The Path Forward Includes Technology, Education, and Collective Action

The remarkable success of "Insured to Death" as a bestseller and Counterforce Health as a technology platform demonstrates enormous pent-up demand for effective solutions to insurance denials. But individual success stories, while important, are just the beginning.

Scaling Technology Solutions

Future development priorities include:

- Integration with all major EHR systems for seamless workflow automation

- Mobile applications for real-time denial management

- API connections allowing third-party developers to build on the platform

- International expansion to help patients in other countries with similar challenges

Educational Content Expansion

Building on "Insured to Death's" foundation:

- Video training series for visual learners

- Interactive tutorials for specific appeal scenarios

- Webinar programs bringing together patients, providers, and advocates

- Certification programs for healthcare advocacy professionals

Policy Reform Initiatives

Leveraging platform data for systemic change:

- State legislature testimony supporting patient protection bills

- Federal agency submissions documenting insurance company violations

- Academic research partnerships quantifying the scope of wrongful denials

- International comparisons highlighting superior approaches in other countries

The Future of Healthcare is Patient-Powered

The combination of "Insured to Death's" comprehensive analysis and Counterforce Health's cutting-edge technology represents more than just another healthcare innovation. It's the foundation of a patient-powered movement that's already transforming how Americans interact with their insurance companies.

Every successful appeal processed through the platform weakens insurance companies' ability to deny care arbitrarily. Every copy of "Insured to Death" purchased and read creates another informed advocate for healthcare justice. Every patient who fights back and wins demonstrates that the system's power imbalance can be corrected.

The insurance industry has spent decades perfecting systems designed to maximize profits while minimizing care. They've counted on patient ignorance, exhaustion, and isolation to maintain their advantage. But armed with AI-powered tools and comprehensive knowledge of industry practices, patients are no longer fighting alone.

The future of American healthcare will be written by those who refuse to accept wrongful denials, who understand their rights and know how to assert them, and who recognize that individual victories contribute to collective transformation. "Insured to Death" provides the knowledge. Counterforce Health provides the tools. The question now is whether enough Americans will use them to create the healthcare system we all deserve.

"Insured to Death: How Health Insurance Screws Over Americans - And How We Take It Back" is available now on Amazon, where it currently ranks as the #1 New Release in both Health Insurance and Health Policy categories. Experience the power of AI-driven healthcare appeals at www.counterforcehealth.org, where patients and providers are successfully fighting wrongful denials every day.

For healthcare providers interested in streamlining appeals processes or patients facing current denials, Counterforce Health offers free consultations to discuss how AI-powered advocacy can help. Contact our team today to join the thousands already using technology to take back control of their healthcare.